Q4 2018 Newsletter

Client Spotlight: Dr. Jerry Popham

This month PMRG is proud to introduce you to one of our clients, Dr. Jerry Popham.

After finishing his fellowship at Harvard, Dr. Popham started a private practice in Denver, Colorado in 1992. Two years later, Dr. Popham started annual trips to Vietnam to lend his plastic surgery expertise to treat Vietnamese children with facial deformities. In 2009, Dr. Popham moved his team – About Face – from Ho Chi Minh City to Hoi An, a small, charming city in central Vietnam dating from the 1500s where he identified a great need for his team’s expertise.

“Team members vary in their motivations to serve,” Dr. Popham said. “We all love the Vietnamese children, love the adventure, want to make a difference in people’s lives, and want to live our beliefs and faith.”

Thank you Dr. Popham and About Face for the priceless services you provide!

Calculating “Return on Investment”

Ophthalmology practices are often faced with making decisions regarding expanding current resources or acquiring new resources, given the nature of the “technology-heavy” specialty. While there are important clinical implications to consider, a practice must also consider the financial implications of these decisions. If an investment can be expected to improve patient care, outcomes, and patient satisfaction, it can override a negative outcome. Therefore, your first step should be to establish clear and measurable goals to determine whether the investment will pay for itself. Once your goals have been defined, there are several strategic decisions with financial implications that require analysis.

These include:

Opening an additional office location, or expanding or relocating a current office space

Adding a new service or equipment.

Upgrading or adding additional units of existing equipment

Adding additional staff or a new practitioner (physician, physician assistant, or nurse practitioner, optometrist)

Initiating a marketing campaign for your practice.

The purpose of this article is to provide a basic framework for analyzing the cost and return on investment (ROI) for these added resources.

Calculating Cost:

The calculation of the true expenditure cost could include all or some of the following:

Acquisition cost

Space – primary space for the new asset or employee.

Collateral equipment or resources required (e.g., plumbing, electrical)

Installation

Development of materials, templates, documentation

Training (initial and ongoing)

Cost

Practice “down-time”

Ongoing support (e.g., software or equipment support, upgrades)

Added personnel

Per-unit cost (e.g., for testing equipment, is there a cost per test or a supply or reading cost per test)

Productivity penalties (does the new resource impede physician or staff productivity? (e.g., electronic medical records)

Legal liability associated with the service

Contingency cost (e.g., the number of post-op visits, the level of “hand-holding” required, for instance from LASIK patients compared to cataract patients)

There could very well be other costs, specific to your acquisition. What is important is to categorize the costs into fixed (e.g., monthly payments for acquisition, rent, salary, support, staff, etc.) and variable (e.g. – per-test cost, supplies, eyeglass frames and lenses, etc.).

Income:

The factors involved in estimating income include

Volume

Perhaps the most difficult to project accurately

Must define

Ramp-up volume

Ultimate volume

Maximum capacity

Income per unit

Is there an existing CPT code that covers the service?

Is the code covered by your payors?

What is the “allowable payment”?

Savings

If the new equipment or service replaces an existing methodology, can the savings be quantified?

Less time

Less staff

Lower cost

Increased productivity

Does the new equipment allow patients to be seen more quickly (e.g., an auto-refractor), and therefore increase patient volume?

Marketing – does the acquisition differentiate the practice from your competitors, and can increased volume be anticipated from this differentiation?

The following spreadsheets will help to illustrate the evaluation process. These analyses are very basic, and the numbers are not representative, so should not be used as benchmark data.

Example – Acquisition of OCT (Retinal Nerve Tomography) Equipment

This analysis is fairly straightforward, and shows that the “breakeven” point is between 20 and 30 tests per month. Since there is an already-established panel of patients for whom this test is appropriate, the “ramp-up” time to achieve a breakeven level of patient volume will probably be relatively short. The projected volumes can be estimated with a fairly high degree of accuracy using diagnosis categorization from the practice management computer system.

In this evaluation, it is assumed that the useful life of the equipment is longer than the time it will take to recover the acquisition investment; it is certainly longer than the life of the lease agreement or the loan repayment period required to acquire the equipment.

Let’s look at another commonly confronted decision: whether to hire an optometrist. We can assume that the optometrist can fill several roles, including managing the optical shop; acting as a technician; seeing post-op patients; providing routine eye examinations; and treating patients with certain optical pathologies, either on their own, or along with the ophthalmologist. We should assume that the optometrist will not bring many patients to the practice. If that is not the case (OD will bring patients), the calculation will show an added dimension.

Example Two – Hiring an Optometrist

This assessment assumes 100% productivity for the optometrist. It also assumes some standard of clinical skills and interest in the projected set of services.

Ramp Up

A more in-depth analysis could assume a “ramp-up” to 100% productivity, with lower income levels projected for the time it will take to build the optometrist’s practice.

As illustrated, the shift from negative to positive cashflow occurs in month five. However, looking at the right-hand column, the cumulative cashflow turns positive in month nine. This is what defines the “Time to Return on Investment” for the addition of this provider.

The calculation for each resource may look different, depending on the specific nature of the resource, and the financial characteristics of the cost and income associated with the resource. The point of the calculations is to project those costs and income sources that can be expected to provide you with the most accurate picture and financial consequences of your strategic action.

It is important to monitor your return on investment monthly to determine whether your projections match actual cost and income. Performing a return on investment assessment is an important function of practice management. Taking the time to perform this important analysis will help to ensure you are making wise financial decisions for your practice in order to avoid “buyer’s remorse.”

Meet the Biller: LaMilla Gilliam

LaMilla Gilliam joined the PRMG team in August 2014. She is a graduate of Kaplan College’s Medical Billing and Coding program. Prior to joining to PMRG, she worked at AT&T as Finance Specialist Manager.

LaMilla is the manager of PMRG’s call center which handles all of the patient phone calls for our clients on many different billing system platforms. The call center also assists some clients with patient collection calls and scheduling appointments. LaMilla is constantly working on new ways to manage and automate our call center capabilities. She enjoys helping patients fully understand their statements and diffusing upset patients.

LaMilla and her husband Tony enjoy spending time with their daughters, Ricki and Triniti, and their two dogs, Angle and Pacino. She is a cheer Mom and mom manager for daughters who are pursuing entertainment careers. LaMilla loves traveling, especially to Disney World!

LaMilla is always willing to take the extra time to solve problems for patients and clients. We are thrilled to have LaMilla on the PMRG team.

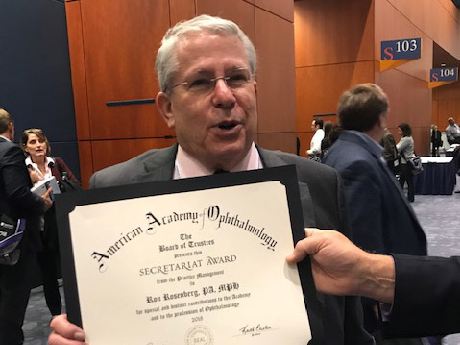

PMRG Founder & President Ron Rosenberg Wins Award

Each year the AAO and AAOE Boards recognize a maximum of two individuals for “special and distinct contributions to the Academy and the profession of Ophthalmology.” Ron was recognized for the 25 years of writing and delivering seminars and webinars for the membership and the profession.

Ron Rosenberg, P.A., M.P.H. Practice Management Resource Group, Inc.

Medical Practice Financial Performance Consulting

Outsourced Billing Services

American Academy of Ophthalmic Executives (AAOE)