What Does It Cost Your Practice to Run Its Personnel Department?

Personnel costs may represent as much as 2530% of overhead in a medical practice. Often included in that financial responsibility are such tasks as

Payroll management

Employee benefit design and administration

Tax filing and administration

Compliance with state and federal workplace legislation

Provision and maintenance of competitive benefits, including health insurance and pension plans

Is your practice too small to have a personnel department? That may be true, but those management functions still remain the practice’s responsibility‹no matter what size practice you are running. Key components of your practice’s financial management are assessing these personnel costs and making ongoing business decisions on how to provide these services cost effectively, in your role as human resources manager.

What Does an Employee Leasing Company Do?

A Professional Employer Organization (PEO) can take over the administration of your current staff and, in some cases, provide new staff members as needed. The practice retains primary responsibility for day-to-day management of work assignments and on-site supervision.

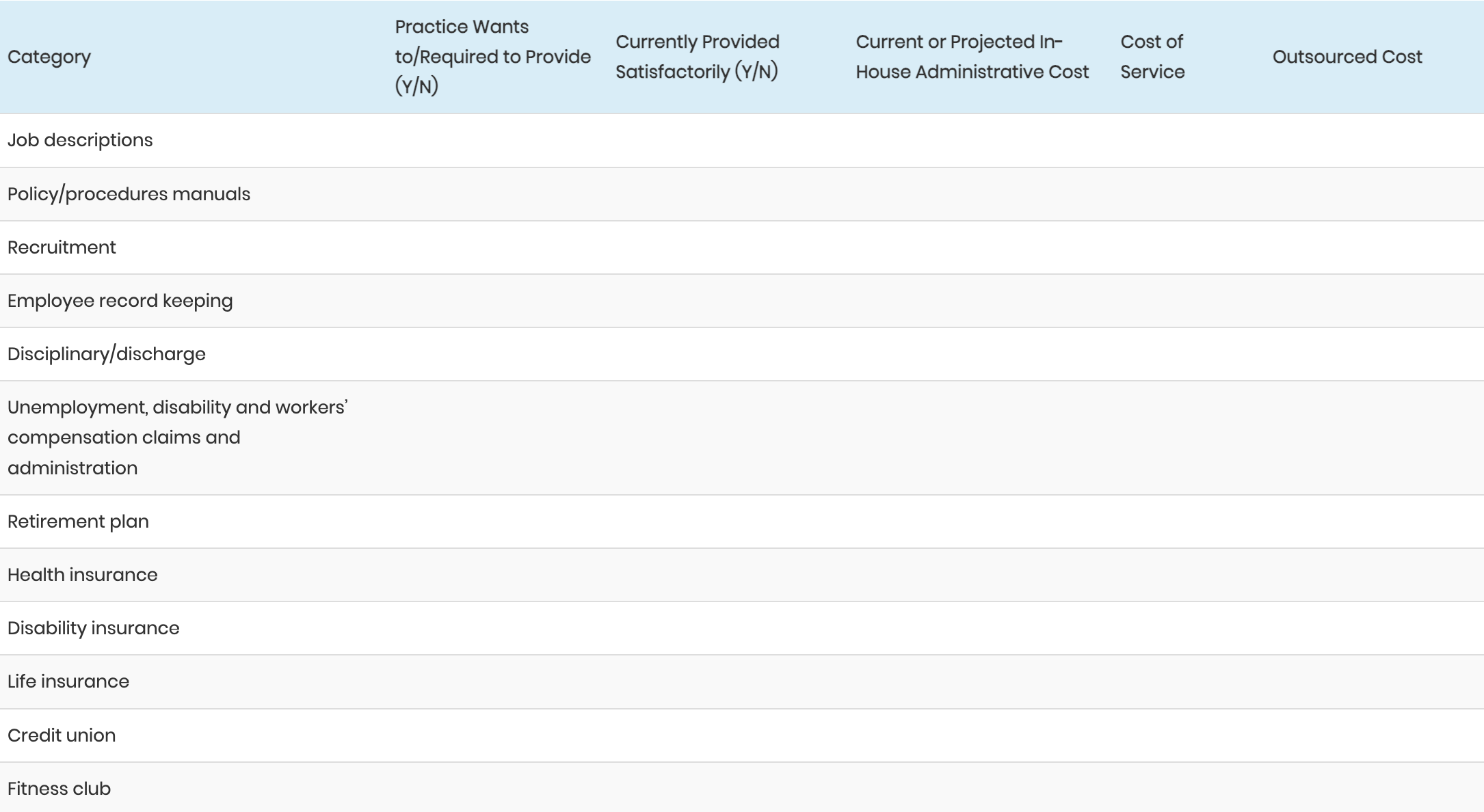

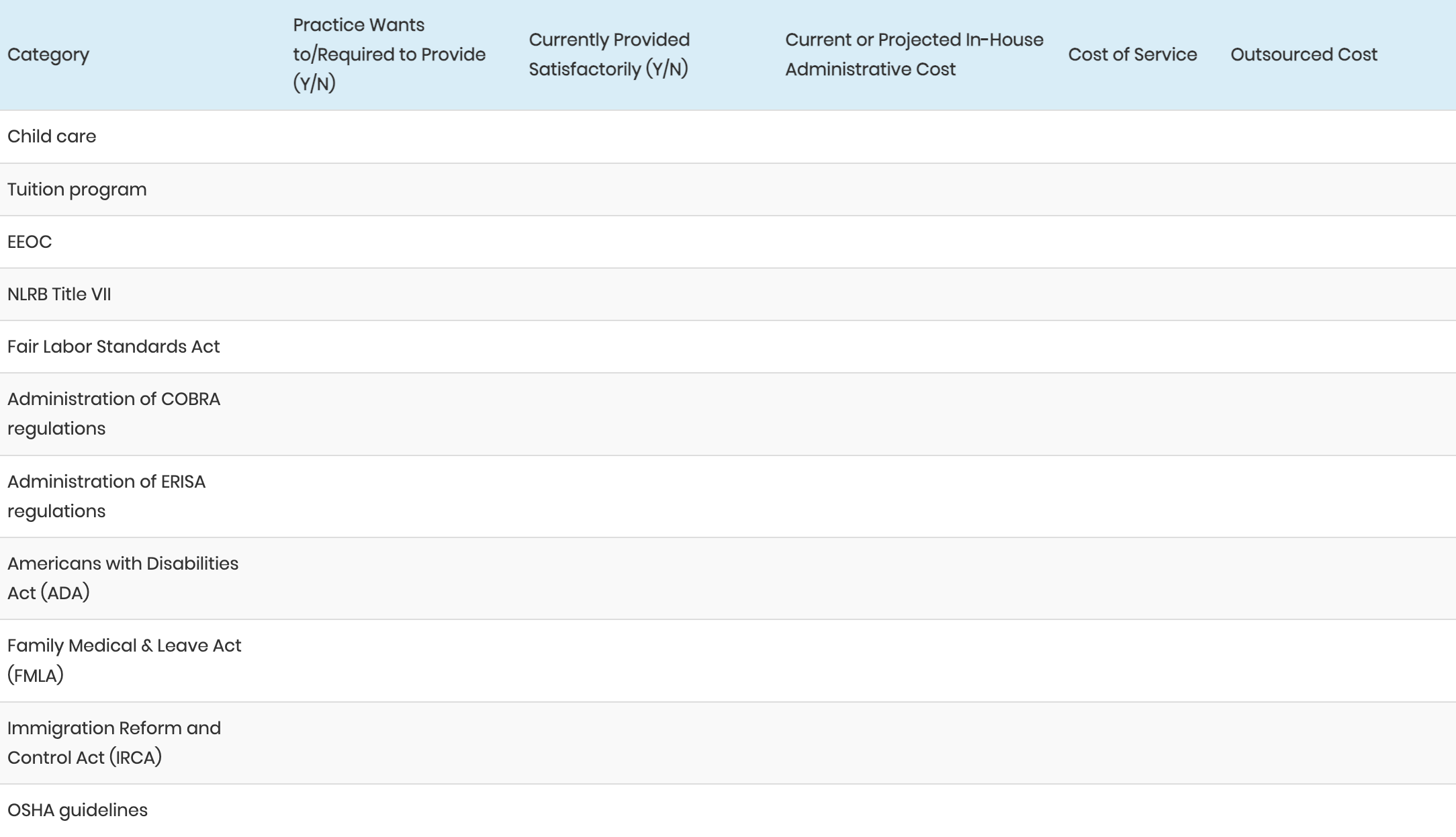

As you review the PEO services listed below, you’ll want to record them in the chart provided. These are tasks you currently handle well in the practice, tasks you perform but find burdensome, and tasks you are not currently doing (but know you should do or would like to do).

Specific PEO services may include

Development and maintenance of employee job descriptions and policy and procedure manuals

Employee recruitment

Employee record keeping

Disciplinary actions and employee discharging

Unemployment, disability, and workers’ compensation claims and administration

Administering employee benefit programs including o retirement plans o health care plans o life, disability, and accidental death and dismemberment insurance o credit unions o cafeteria benefits, such as fitness club memberships, child care, tuition reimbursement programs, etc.

Responsibility for compliance with regulations o Equal Employment Opportunity Commission (EEOC)

Title VII, the National Labor Relations Act (NLRA)

Fair Labor Standards Act

COBRA

ERISA

Americans with Disabilities Act (ADA)

Family Medical & Leave Act (FMLA)

Immigration Reform and Control Act (IRCA)

Cost/Benefit Analysis

The attached graph is an example of a framework that can help you in determining whether to use a PEO. The column headings are interpreted as follows:

“Category” refers to each specific component of the management of your staff‹that is, of the human resources department of your practice.

“Practice Wants to/Required to Provide (Y/N)” is simply a checklist of those HR components the practice desires or needs.

“Currently Provided Satisfactorily (Y/N)” is a checklist of those items that the practice provides and provides at a level of quality acceptable to the practice.

“Current or Projected In-House Administrative Cost” is the cost of administering each item, separate from the cost of the item. For example, there is a cost for administering the health insurance plan, separate from the insurance premium. Other items, such as the maintenance of employee records, have no significant cost other than that of administering (maintaining) those records. Estimate the administration time actually spent on those items currently provided as well as the administration time for those items that you are not currently providing but want to provide; then multiply the time for each item by the employee cost (salary/wages plus benefits) of a staff member providing each item.

“Cost of Service” is any cost in addition to the administrative cost (e.g., for insurance premiums, subscriptions to regulatory newsletters, etc.).

“Outsourced Cost” is the cost for the PEO to provide the service. You may not be able to ascertain from the PEO the cost for individual components of a service. In that case, simply compare the PEO’s proposed total cost to your aggregate in-house costs for the same set of components.

Current or Projected In-House Administrative Costs

By completing the matrix, you can begin to calculate the cost-comparisons for retaining the HR functions in the practice as opposed to outsourcing to a PEO. Many comparisons cannot be concretely measured. Some benefits can only be obtained through a PEO because of its ability to purchase services for a larger pool of employees. Don’t forget the cost of time required to manage, and to stay educated in, the various benefit-package offerings (retirement, investment, OSHA updates, etc.). Keep in mind that if you outsource your HR to a PEO, the exposure to penalty and interest charges for late-filed or late-paid payroll taxes and sanctions for technical administrative or regulatory shortcomings belongs to the PEO, not the practice.

Ideally, the practice will be able to reduce the tasks required of its internal administrative staff, saving enough money to compensate for the fees the PEO charges. The time saved on non-revenue-producing activities can contribute directly to the practice’s bottom line by allowing you to concentrate on activities that enable the practice to grow or that make it more efficient and effective.

Summary

Most ophthalmology practices, if examined in an administrative audit, are found to be at least somewhat deficient in the administrative management of their staff. With so much to be gained by having additional management time to concentrate on the practice’s operations and financial performance, and so much to be lost by not having every “t” crossed and “i” dotted in employee administration, it seems worthwhile to explore the option of outsourcing human resources management.

Coauthors:

Ron Rosenberg, PA, MPH, Practice Management Resource Group, San Rafael, California

Irene Chriss Director, AAO Practice Management Dept.