Monthly Management Reports

In past issues of this newsletter, we’ve worked through the methodology to use in the analysis of your practice’s financial performance. In the next two issues, we’ll look at a set of regular management reports formatted for review by you and the physicians in your practice.

The reports to consider include the following:

Income

Product-line

Productivity

Payor-mix

Collection performance

Accounts Receivable

Expense

Expenses as a percent of income

First, a review. In order to have meaningful management reports, the setup of your computer system is critical (see the March 13, 2000 issue of this newsletter). Particular emphasis should be placed on your assignment of each insurance plan to a payor class based on expectation of payment.

Second, remember that some of the reports we discuss here will have to be generated manually, using data from your computer billing system. These may include your product-line, productivity, and payor-mix reports, as well as a summary table of collection performance.

Third, keep in mind the purpose of this report set. It should be a concise snapshot of the performance of the business of the practice, and it should be reviewable in 15 to 30 minutes. This report set should be distinct from the reports you generate for managing your billing operation and for collecting receivables.

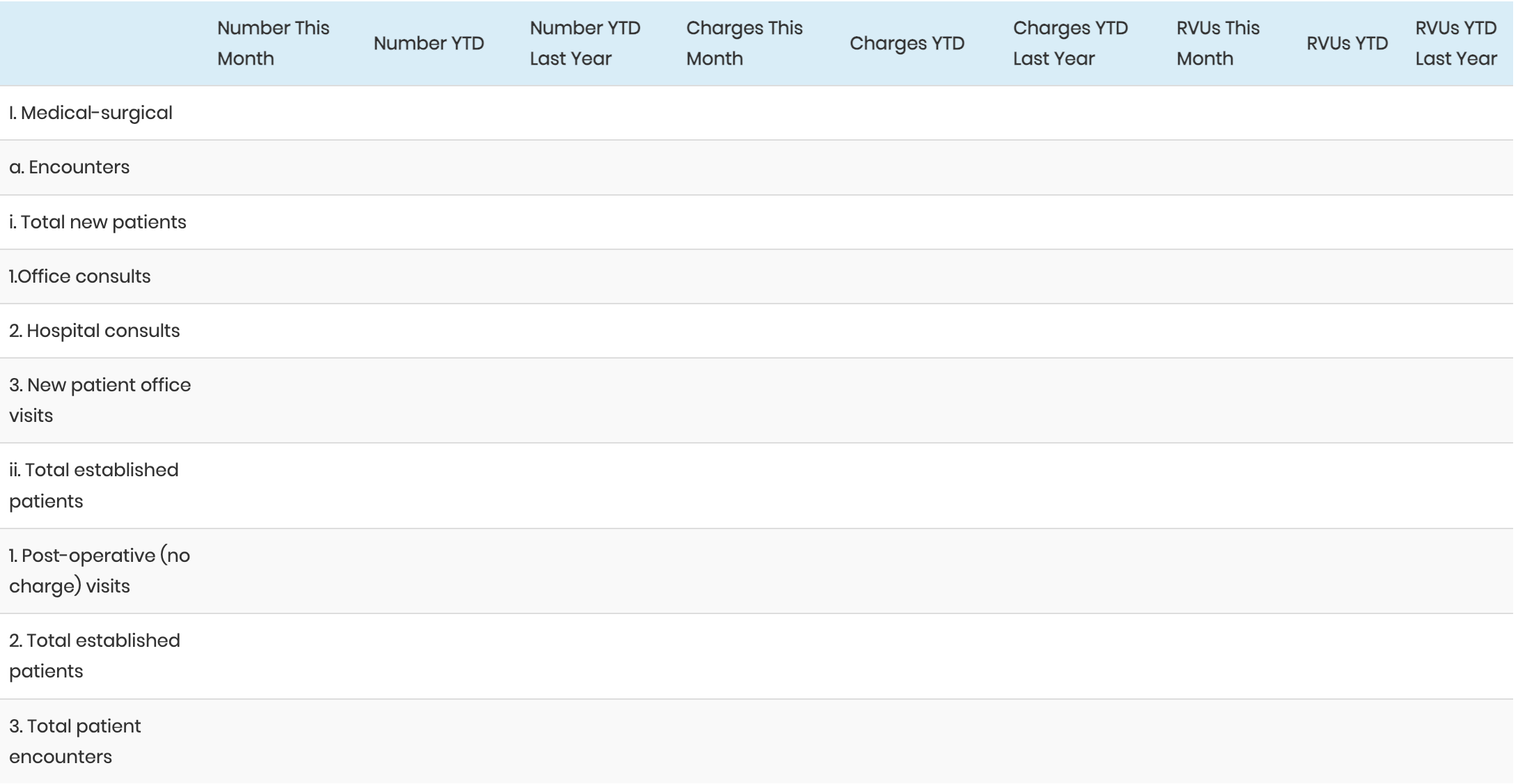

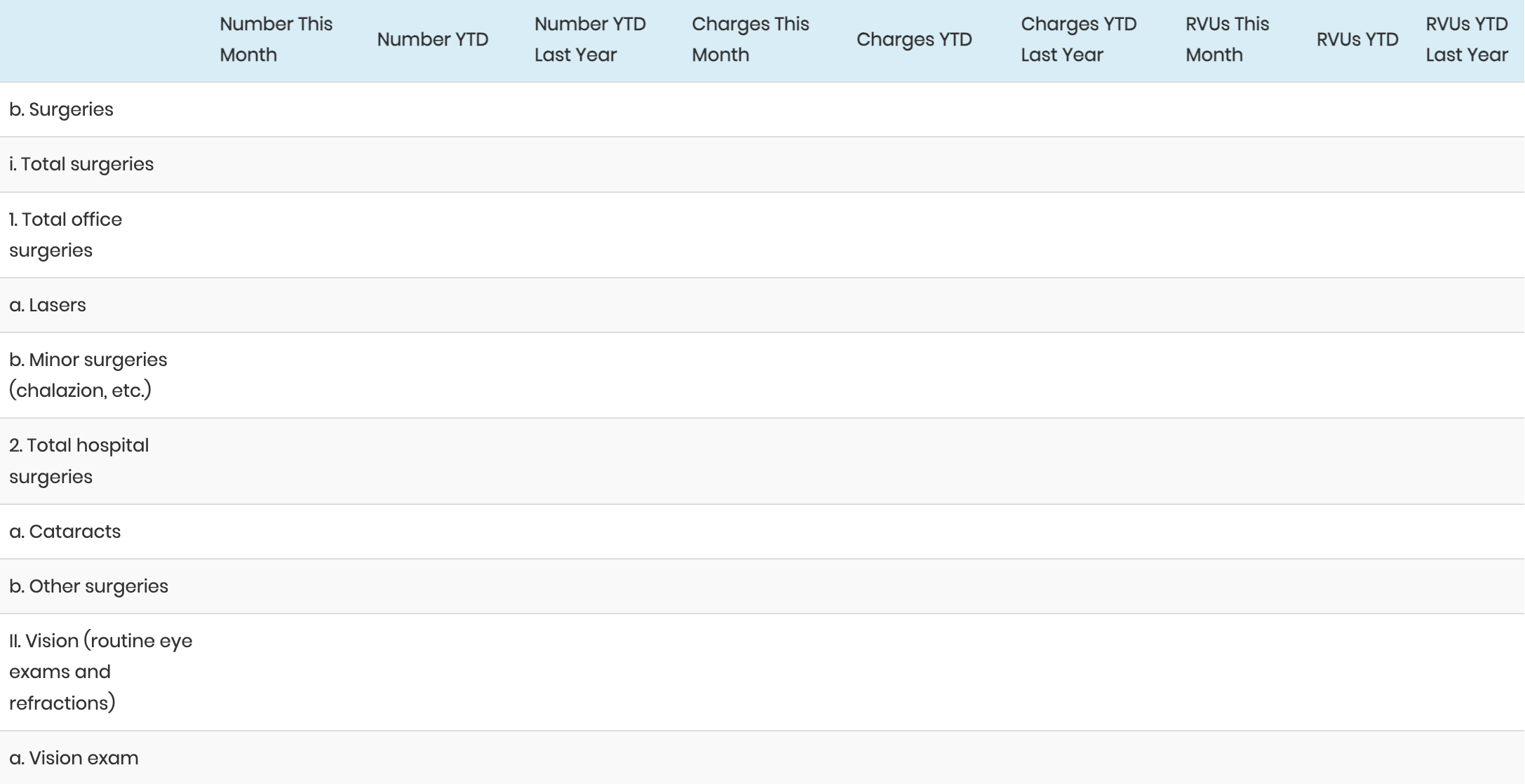

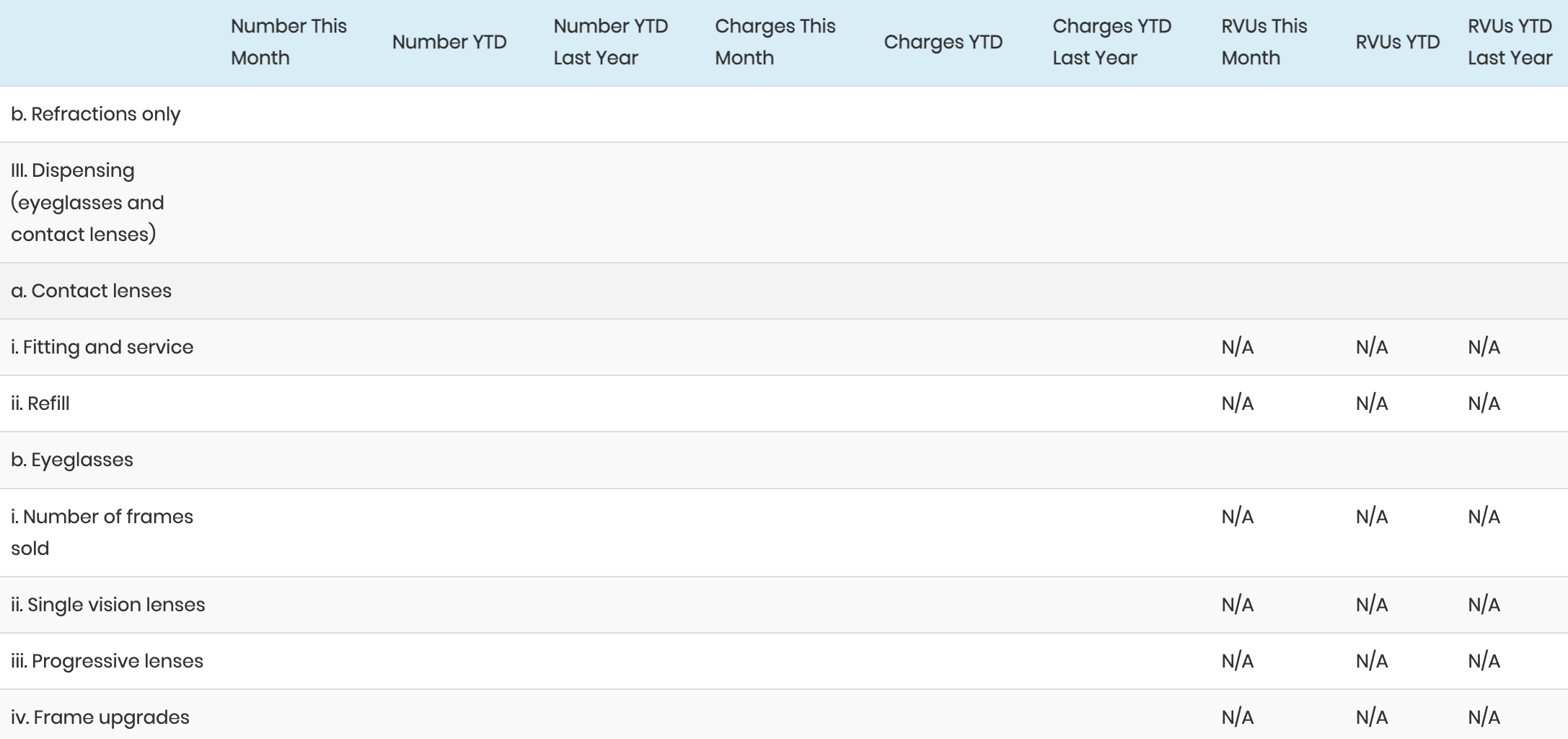

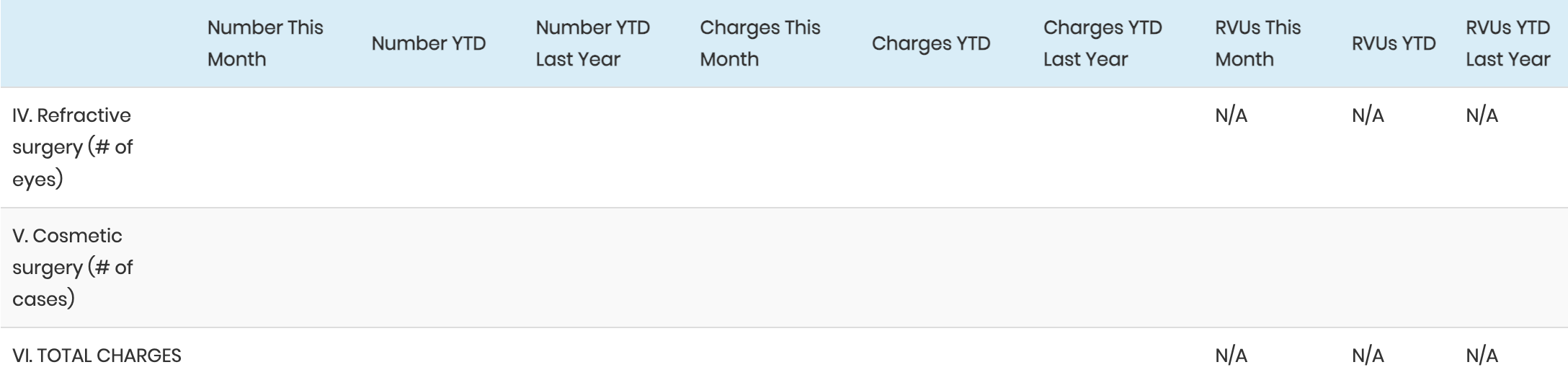

Product-Line and Productivity

The first issue of Watching Your Bottom Line explained this report. To review, it can be presented in major categories and subcategories with volumes expressed as the number of charges, dollars charged, and RVUs. The categories and subcategories are arrayed in a chart as in the following example:

Payor Mix

In this report (originally covered in the May 19, 1999 issue of Watching Your Bottom line), insurance plans are assigned to categories and tracked to define the characteristics of the practice’s “customers.” The data can be displayed as follows:

This distribution is tracked over time. Additionally, it can be displayed in a chart.

These reports describe the practice’s clinical activity and patient type. In the next issue we’ll put these reports together and show how to describe the examination of the charges generated by this activity, of the collections from these charges, and of the collection performance on charges from earlier time periods.