A New Method for Evaluating Your Fee Schedule and Calculating Collection Target

The August/September 1999 issue of Watching Your Bottom Line discussed evaluation of your practice’s fee schedule based on the use of the Resource-Based Relative Value Scale (RBRVS). In that issue, the RBRVS was used to identify overpriced and underpriced services, as well as to calculate the relationship between the practice’s fee schedule and the allowable payment schedules of the practice’s payors.

Many managed care payors are moving to an allowable payment schedule based on the Medicare Fee Schedule (MFS). For those of you who have a managed care plan that is paying a percentage of the Medicare Fee Schedule, this issue’s sample calculations will simplify analyzing your fees, recalculating your fee schedule, and calculating a collection target.

MFS Calculations

Fee Analysis

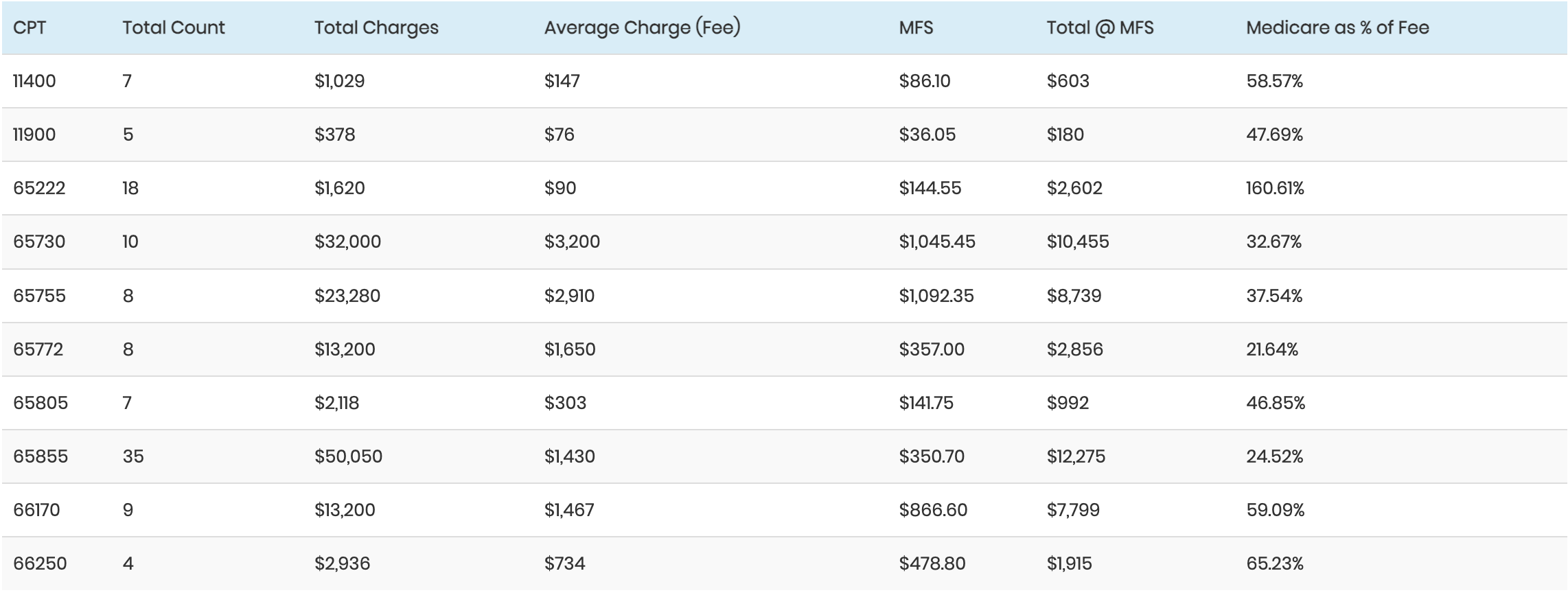

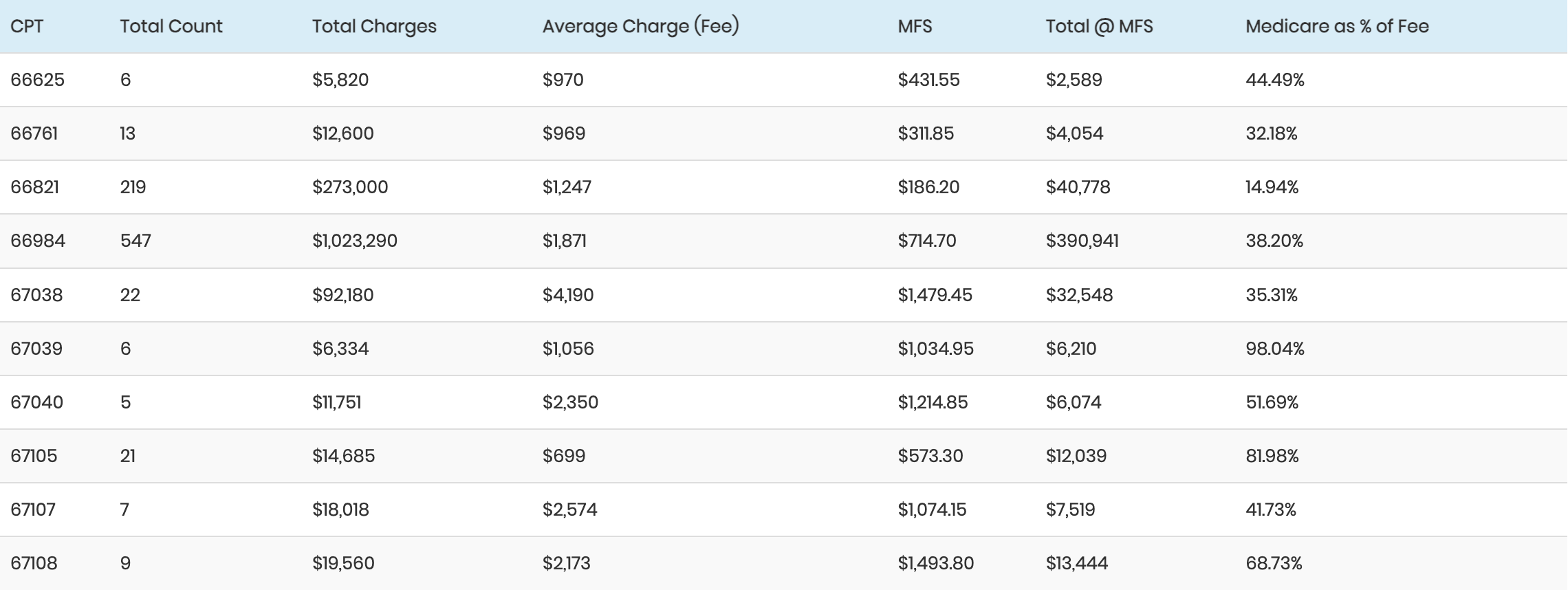

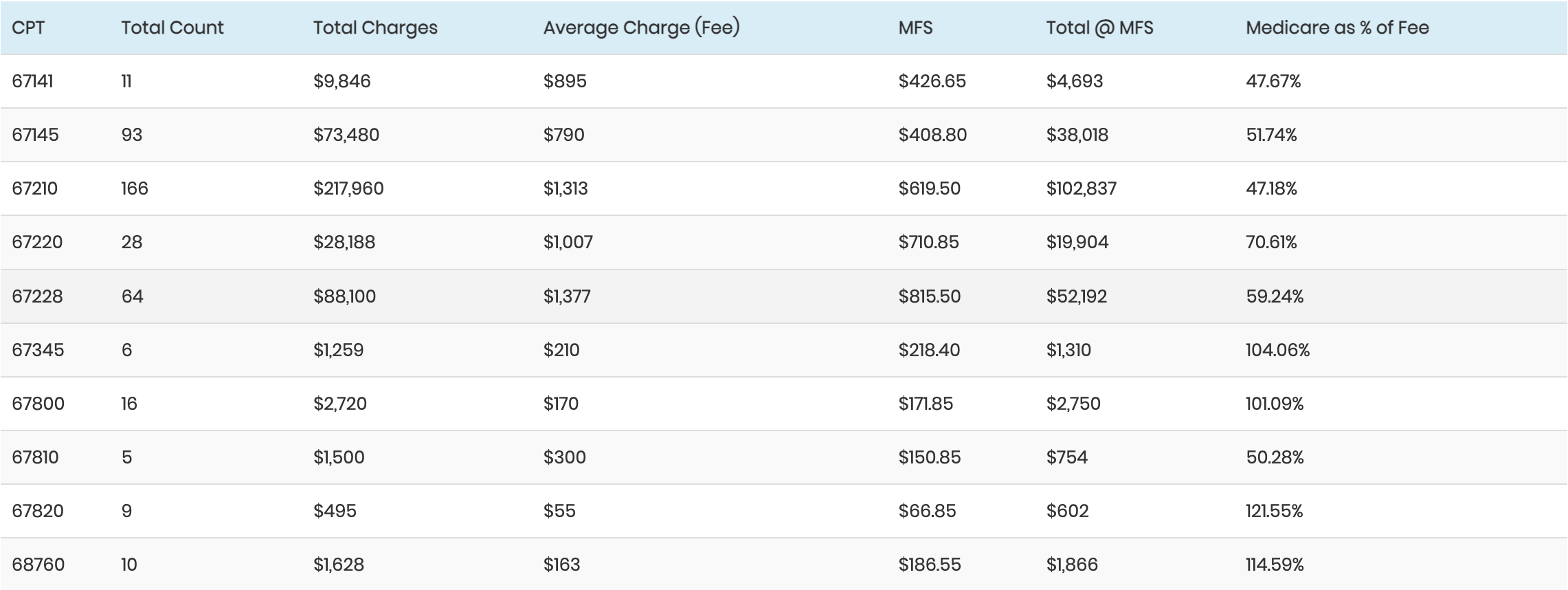

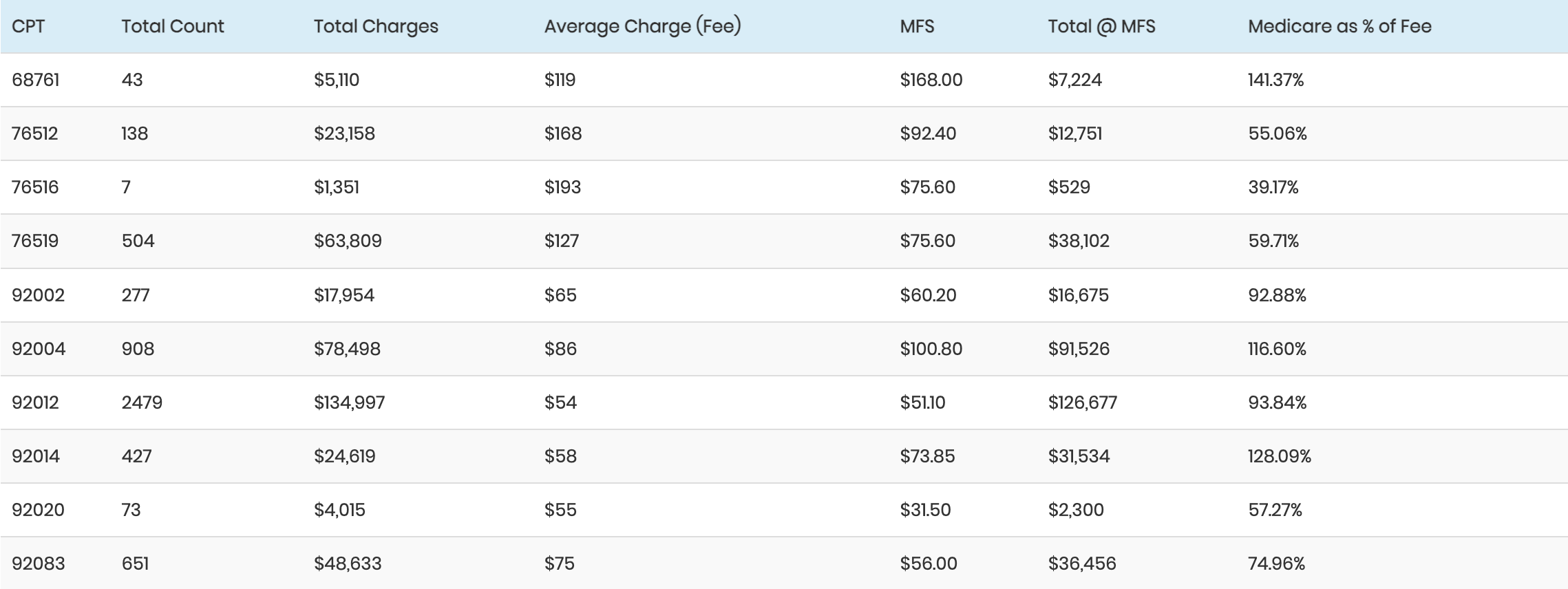

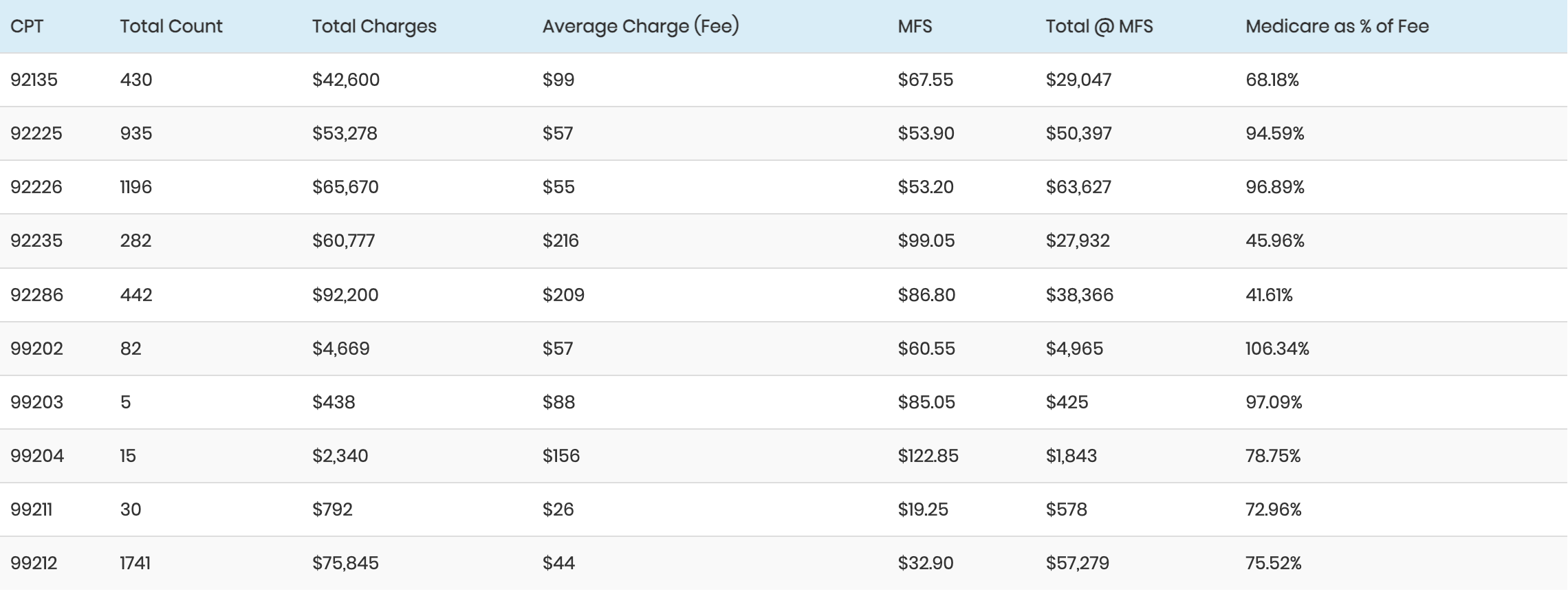

The following table shows how each fee (average charge) compares to the medicare allowable as well as how the total charges at the practice’s fee compare to the same services based on the MFS. (The fees and MFS allowables shown in the table are for demonstration purposes only.)

-

Average Charge (“D”) = Total Charges (“C”) ¸ Total Count (“B”)

MFS (“E”) = Medicare Fee Schedule

Total @ MFS (“F”) Total Count (“B”) X MFS (“E”)

Medicare as % of Fee (“G”) = Total @ MFS (“F”) ¸ Total Charges (“C”)

From the table on the previous page, several things can be determined:

Any service in which the medicare allowable as a percentage of the fee (column G) has a value greater than 100% and is being charged at less than the MFS‹each time that service is charged, income is lost. There are several (8) services with fees lower than the MFS.

The relationship between the practice’s fees and the MFS ranges from the MFS at 14.52% of the practice’s fee (CPT 65855) to the MFS at 160% of the practice’s fee (CPT 65222).

The overall relationship between the practice’s total charges and the total if all services are charged at the MFS is 52.07% of the MFS. Another way to state that statistic is to say that the practice’s fee schedule is approximately 200% of the MFS.

-

Since the two main purposes of your fee schedule are (1) to assure that there are no overpriced or under priced services and (2) to establish a value for your services from which your financial performance can be assessed, and since most payors are using the MFS as the basis for their allowable payments, it makes sense to use the MFS as the basis for your fee schedule.

We recommend that you calculate your fee schedule as a multiple of the MFS.

-

There are several procedures that should guide you in the selection of the multiple of the MFS you use to recalculate your fee schedule.

First, you should examine your payor-mix. In some parts of the country there is virtually no indemnity insurance (that is, a plan in which the patient is responsible for the balance of the charge after the insurance pays). If you have very little or no indemnity insurance, as long as each fee is above the level of the Medicare and managed care allowable payments, no money will be left on the table. The fee schedule becomes simply a level from which to measure discounts to the various fee-for-service contracted plans (Medicare, Medicaid, PPOs, HMOs, etc.).

Next, determine the relationship between the allowable payment levels of the managed care payors in your area and the MFS. You want your fee schedule to be well above any of those allowable payment levels.

Let’s assume that the allowable payments from the managed care plans in your community all fall within the range of 85% to 120% of the MFS, and you have very little indemnity insurance. You want a fee schedule that will ensure that you’re not leaving any money on the table by charging less than the payors are willing to pay. If you calculate your fee schedule at 150% of your local MFS, you will not leave money on the table, and you will not be punishing your indemnity-insured patients by leaving them with large balances.

(NOTE: The fee-schedule level of 150% of the MFS is an example of a calculation, not a suggestion. You should calculate your own multiple.)

-

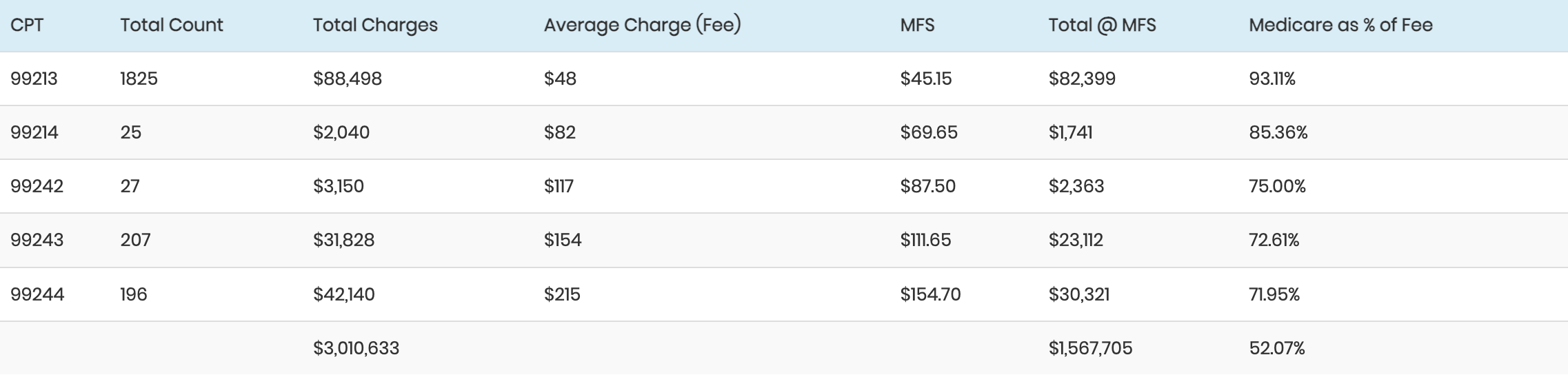

As in the previously described method, the first step in the calculation is to determine your payor-mix. The following is an example of a payor-mix based on charges with capitation excluded.

For the sake of these calculations, let’s assume the following:

The practice’s fee schedule is approximately 200% of the MFS (from the fee analysis table above).

The community’s managed care plans pay 125% of the MFS.

The state’s Medicaid pays 75% of the MFS.

The state’s Workers Compensation plans pay at the MFS level.

Payor class Charges Mix Target Target X Mix

Self-Pay $179,082 5% 30%a 1.5%

Indemnity $89,541 2% 95%b 1.9%

FFS Managed Care $984,953 25% 62.5%c 15.63%

Workers Compensation $44,771 1% 50%d 0.5%

Medicare $2,417,612 62% 50%e 31%

Medicaid $134,312 3% 37.5%f 1.125%

Medi/Medi $44,771 1% 40%g 0.4%

TOTAL $3,895,042 100% 52%

Self-pay is estimated based on your knowledge of your self-pay patients‹that is, how many are indigent, how many are self-insured, etc.

Indemnity is non-contracted care, where the patient is responsible for the balance of your fee after the insurance pays. Realistically, 95% collection is a reasonable target for these charges.

The target for fee-for-service managed care is calculated by comparing your fee schedule (200% of MFS) to the community allowables (125% of MFS), or 125 ¸ 200 = 62.5%.

Workers Compensation in this state pays at the MFS (e.g., 50% of charges).

Medicare compared to your fees = 100%/200% = 50%.

Medicaid pays at 75% of MFS so the target is 75% of 50% = 37.5%.

Medi/Medi = 80% of the Medicare target = 40%.

After the individual targets for each payor class are derived, each target is multiplied by the percentage of the total charges represented by that payor class. When all of those products are added, the sum of those products is the overall collection target‹52% of the charges in this example.

Maintenance At the beginning of each year: 1. Reanalyze the managed care payors’ allowable payment schedules, determine which years’ MFS they are using, and at what multiple; and 2. Recalculate your fee schedule using the current year’s MFS. As always, we encourage you to use these procedures in your practice, thereby managing the performance of your business office against calculated targets.

Ron Rosenberg, PA, MPH, Author Practice Management Group San Rafael, California

Irene Chriss Director, AAO Practice Management Dept