Q3 2019 Newsletter

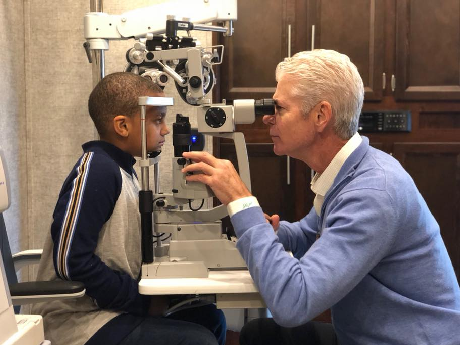

Client Spotlight: Boling Vision Center

For this month’s Client Spotlight, PMRG is excited to present Boling Vision Center. Boling Vision Center has been compassionately serving the families of Michiana – a region in northern Indiana and southwest Michigan – with a state-of-the-art, personalized eye care experience for nearly 60 years.

In 2018, Boling Vision Center and the Elkhart Education Foundation launched the Kindness to Prevent Blindness program. All 1st, 3rd, 5th and 8th graders are required by the state of Indiana to receive a vision screening each year through their school.

Historically, no follow-up care has been provided beyond parental notification that their child passed or failed the vision screening. Kindness to Prevent Blindness brings a mobile clinic to local schools to provide the vision exam, plus two pairs of prescription glasses at no cost to all children that fail their state-mandated vision screening.

The new program aims to provide a continuity of care by removing the referral gap and providing same-day exams and glasses to children at no cost. The Boling Vision Center team visited 17 schools in 2018-19 and will expand to 68 schools in 2019-2020!

-

It is common for medical practices to struggle with collecting their patient obligations. It’s not that your practice didn’t provide quality care or the patient was dissatisfied with your service. It is simply that in some practices, collecting patient obligations at time-of-service is not emphasized. Patients often leave the office without paying co-payments, deductibles, or old balances.

Unfortunately, medical bills get put on the back burner because, generally speaking, the mortgage payment, car payment and other various bills have top priority for many people.

Here are some ways the management of patient balances can be prioritized:

Avoid balances by ensuring that the patient obligation is paid before the patient leaves the office;

Communicate clear financial policies so that patients understand that payments are required at time of service;

Use a well-managed process of sending patient statements and following up with phone calls to collect balances;

Enforce policies; for instance, don’t schedule patients for the next visit if they have an outstanding balance, or charge a statement fee if they do not pay at time of service;

As a last resort, create a mutually-agreeable payment plan in order to make the patient obligation more affordable, and therefore more likely to be paid.

-

With a payment plan, an agreement is made between the patient and the practice for the patient to regularly pay a portion of their outstanding balance until the debt is resolved. A payment plan is really financing and is like financing any other purchase. Unlike a major appliance or an automobile, the services you provide cannot be taken back if there is a default on the payment.

Since your practice provides services that are not paid-in-full at the time of service, technically you are offering financing for those services (according to the Federal Trade Commission). This applies even when a claim is submitted to an insurance carrier for payment. Until all payments are received, you are extending credit to the patient, the insurance carrier, or both.

-

Administrative costs

The time-value of money

Defaults (non-payment)

Legal and regulatory requirements (e.g., the Fair Credit Practices Act)

-

Patient training: Making patients aware of your financial policies when their appointment is scheduled

Payment management: Being willing to “just say no!” For example, if a patient arrives and says, “I forgot my wallet,” respond with, “We’d be happy to re-schedule your appointment”.

Insurance Management: Knowing each patient’s financial responsibility (co-payment, deductible, existing balances)

Insurance Contract Management: Knowing the contractual agreements for each of the insurance plans in which you participate:

Between your practice and the insurance carrier

Between the patient and the insurance carrier

Between the patient and the practice

Collection for non-covered services: If a service is not covered by insurance, payment should be due at time of service.

Insurance coverage limitations

Insurance verification: Verifying coverage, benefits, co-payments, deductibles

Deductibles

Amount

How much remaining

Appointment reminder: Communicating financial policies and that payments are required at time of service

-

It is imperative that you know

The size of the deductible

The amount remaining unpaid

The rules for determining the amount to collect

Whether there is a payment instrument as part of the plan (i.e., a designated charge card provided by the plan or the employer)

Key Elements of Your Financial Policy

Payments at time of service

No-show fees

Statement fees

The patient’s responsibility if inaccurate insurance information is provided

Financial Policy Implementation

Patient Training

Requiring a signature on the payment policy during the first encounter with the patient

Reminders:

During scheduling

As part of the reminder call

On arrival

Algorithm for Managing Patient Balances

Identify patient responsible balance

Determine if the patient can pay at the time of service

Yes – Collect

No

Re-schedule if issue is merely logistical

Refer the patient to another facility able to provide charity care if they are unable to pay.

Identify payment source

Credit card

Funding company

Differentiate between those who truly cannot pay and those who do not want to pay

How to Assist Patients in Paying

Credit cards

Medical Credit/Funding Companies

Credit Cards

Accept them

They facilitate payment at time of service

Comparison-shop for discount rate and fees

Develop an on-line credit card payment portal

Simply take the payment on-line

Interfaced into your practice management system

Be aware of the liabilities in retaining credit card numbers

Avoid taking on the role of a bank. Do not put your practice in the position of extending credit. There are entities (see #5 above) that will do that for you

When all else fails, arrange a payment plan. Here is sample verbiage your practice can use:

-

Payment MUST be made on or before the 10th of each month. There is no “grace period.”

You must remit at least the amount agreed upon, unless prior approval has been obtained or you are making a larger payment.

Should a payment be late, you must call before the due date to avoid a collection notice.

Occasionally, things come up that make it difficult to make a promised payment. Should this happen, just let us know and the payment may be delayed for that month ONLY.

The payment agreement is a privilege for those who need a little extra time. Should this privilege be abused by late or inconsistent payments, the agreement will become void at our discretion and the account may be placed with an outside agency for collection. This will affect your credit rating.

If we send the account to an outside agency, a 35% fee of the total remaining balance will be added to the account.

Should you receive payment from your insurance company, it MAY NOT be used in place of your regularly scheduled payment. Any insurance monies you may receive should also be forwarded to us until your balance has been paid in full.

-

Debt collectors and creditors must follow federal and state laws when adding or charging interest on debts.

Legal verbiage – Section 808(1) prohibits debt collectors from collecting any amount unless the amount is expressly authorized by the agreement creating the debt or is permitted by law. For purposes of this section, “amount” includes not only the debt, but also any incidental charges, such as collection [53 Fed. Reg. 50108] charges, interest, service charges, late fees, and bad check handling charges.

Consequently, any statement fee or interest must be clearly defined in the payment plan agreement (in addition to the signed financial policies.)

There are many other rules and regulations around collecting debts that must be followed.

Post-Dated Checks – A post-dated check is not collectable if the person or entity to whom the check is written knew that the account did not have the funds to cover the check on the date the check was written.

The Fair Debt Collections Practices Act covers rules governing patient collection calls.

The Fair Credit Reporting Act covers reporting delinquent accounts to a credit-reporting agency.

In the face of the legal and regulatory requirements, we recommend that you don’t charge interest.

-

Many practice management software packages can manage payment plans. If your PM software cannot automate a payment plan, you should seriously consider not entering into a plan. You should certainly not consider charging interest if you cannot automate the calculation of that interest.

Example Procedures to Follow:

Verify the patient does not have previous accounts with an outstanding balance. If there are multiple accounts with balances due, a payment plan needs to be established to cover all accounts.

Patient payment plans are not allowed if insurance benefits were not assigned but were paid directly to the patient and the patient chooses not to remit them to the Clinic.

Determine if other methods of payment are possible (i.e., check by phone, credit cards, family members, etc.). If yes, secure payment via phone or document the expected date in the system.

No payment plans will be carried over longer than 12 months without proper documentation.

No payment arrangement will be made for less than $25 per month or extend longer than 12 months without proper documentation pertaining to the patient’s financial situation.

If unable to comply with these guidelines, refer to your charity care policy.

No plans should be established with patients under the age of majority (18).

Advise patient/guarantor that all future services are payable in the usual manner and will not be automatically added to patient’s current payment plan.

All requests to add future charges to an existing patient payment plan will be treated as a new plan.

The Financial Service Representatives will review the missed payment report or the system to monitor the accounts for current payments.

In the event a payment is late, all prior amounts plus the current payment due must be received in order to reactivate the payment arrangements.

Default in a patient/guarantor’s payment plan results in a pre-collect/final notice letter being sent:

First missed payment will be reviewed by the Financial Service Representative.

Pre-collect letter will be sent to patient in 30 days.

Failure to bring the payment plan to a current status will result in turnover to collection agency 25 days from the pre-collect notice.

-

$0-$200 — Account is due and payable within 30 days from date of billing.

$200-$1,000 — Account is due and payable over a six-month period with six equal monthly payments from date of billing

$1,000-$2,500 — Account is due and payable over a 12-month period with twelve equal monthly payments from date of billing.

Over $2,500 — If account balance is over $2,500 and cannot be paid in full within a 12-month period, the patient/guarantor will need to seek financing from a bank or another lending institution.

-

Do not put yourself in the position of sending monthly statements and managing the receipt of payments. Use every tool to avoid funding patient balances.

Implement and enforce financial policies

Be sure to verify the patient’s insurance, including patient responsibility amount

Practice effective collection at the time of service

Accept credit cards

Be aware of and consider accepting healthcare funding resources

Meet the Biller: Candace Smith

Candace joined the PRMG team in May of 2010. She graduated from Everest College with a certification in medical billing. She began her medical billing career with PRMG as an intern and worked her way up through the ranks to her current position as a team leader.

Candace handles a number of our accounts and manages a team that works with clients on the AdvancedMD software platform. She enjoys working closely with clients and making sure their accounts are handled.

Candace lives with her three children, Richard (21), Jada (16) and Chloe (6). Richard is a senior in college. Candace is a “momager” for her daughters who have had various acting jobs for productions in the Chicago area. Jada has been on Shameless and The Chi already in her young career. Watch for more stellar appearances of these budding stars.

Candace is a history and politics buff and is active in her church. We are extremely glad that Candace is a member of the PMRG team!