Q1 2020 Newsletter

Client Spotlight: Dr. Daniel J. Robinson

This quarter, PMRG is proud to spotlight Dr. Daniel J. Robinson, a board-certified ophthalmologist with over 20 years of experience, including practicing as a partner at 20/20 Eye Physicians of Indiana since 1990. He also holds hospital appointments at St. Vincent Hospital and Health Centers and Naab Road Surgery Center.

Dr. Robinson graduated with his medical degree from the Indiana University Medical School, where he was a member of the Alpha Omega Alpha Medical Honor Society. His postgraduate training included an internship at St. Vincent Hospital and residency training at Indiana University Medical Center, serving as Chief Resident during his final year.

In addition to his training and practice experience, Dr. Robinson also has performed numerous eye surgeries on charitable missions to Panama and Guatemala. This past year, Dr. Robinson took his 26th trip to Panama and Guatemala, where he performs 90-100 surgeries per trip, including surgeries for pterygiums, trauma, and strabismus in children. Over the years, he’s done more than 1000 surgeries as part of this work, which he does through the His Servants Ministry. Dr. Robinson says the work is humbling, although oftentimes he thinks he gets more out of the surgeries than his patients. Watching their excitement with the results is priceless.

Financing Eyecare Services

Many ophthalmology practices find themselves functioning as a finance company for patients’ unpaid balances and co-payments. Carrying some of these balances for certain managed care plans may be inevitable, but acting as a finance company—a finance company that charges nothing for its services—is not a business strategy in your best interest.

The best collection strategies include collecting at the time of service; submitting “clean claims” in order to effectively collect all contracted claims; and offering various forms of financing for balances owed by patients. Financing allows you to collect payments when the patient is not able to pay cash or to write a check at the time of service.

Patients are accustomed to physicians accepting credit cards to pay medical bills. Practices accepting credit cards have experienced improved cash flow, reduced billing costs, reduced uncollectibles, etc. Unfortunately, many practices don’t adequately promote the use of credit cards as a valuable service for the patient.

Practice staff can encourage the use of credit cards by their patients using several different approaches, including the following:

Having prominent signage promoting the practice’s acceptance of credit cards (this signage is usually provided by the credit card vendor)

Advising patients (when scheduling telephone appointments) of your payment policy. Good telephone training is critical for this step. Patients should never be made to feel that the telephone conversation is focused on a financial transaction rather than on their medical needs. The Academy’s new online telephone training course can be accessed at http://www.eyenet.org/member/ops/pm/index.html.

Including your financial policies in your patient information brochure, website, and telephone recording.

Posting a sign at the patient checkout station.

Including credit card payment options on all bills you send out.

Offering to handle the transaction by credit card when you make collection calls to patients.

Effective Communications

Communication of your new financial policy to established patients needs to be handled diplomatically. When staff members are learning a new policy, they may feel uncomfortable asking for credit card payments. This initial discomfort should not be conveyed to the patient. Rehearsing with a script will help. Some script phrases might include:

When making an appointment by phone or when leaving the office: “We’ll see you at 10:00 am on Wednesday the 28th. Don’t forget that your PPO requires that we collect your $10 co-payment before you see the doctor. For your convenience, we can place the charge on your credit card.”

When patients arrive in the office: “Hello. It’s nice to see you. I see that your insurance requires a $10.00 co-payment. At the end of your visit, I’ll be able to give you an itemized bill for your records and accept your payment by credit card, check, or cash.”

As you change policies and are successful in both avoiding creating and reducing outstanding receivables (60–90 day), you can use either credit cards or alternative funding programs to reduce the old receivables. These patients should be contacted and offered the opportunity to handle their account by credit card or alternative funding. For those accounts in which payment is not received, either send them to collection (more than 90–120 day) or write off the balance (in the case of financial hardship or low balance). Note: When writing off Medicare co-payments, you must document financial hardship. Write-offs for financial hardship should not be routine office policy.

Surgical Patient Collections

Many surgical patients are responsible for a portion of their bill. This amount is usually known by your billing staff in advance. Ideally, collecting all or a portion of the bill for noncovered surgical care should be done prior to hospitalization, but in some instances the patient may be too anxious to take part in a financial discussion. Good staff training is critical under these circumstances. While almost all patients understand that you are running a business, no one wants to feel like a customer while receiving unsettling medical information.

Good patient information brochures, good patient and family education, and discussing finances in private (away from the reception area) are important.

A message at the bottom of the statement—such as “We can accept a credit card payment by phone to handle this balance. If a credit card payment is not an option for you, please phone the office to discuss alternative funding programs”— is recommended.

Optical Shop

The optical dispensary is a retail business. As with other retail businesses, the goal is both to provide patients with what they want and to maximize sales and profitability. Optical unit sales can range from less than $100 to more than $1,000. As in other segments of our consumer market, financing is a way to enable patients to have the eyeglasses they really want but may not be able to pay for up front.

Types of Credit Card Transactions

Most banks or other financial institutions have a processing fee that ranges from 1.5% to more than 5% and is either a per-transaction fee or a percentage of the charge. Professional medical associations, such as the Academy, the AMA, and the state medical societies, have sponsored credit card plans that offer physician or association benefits. Credit card companies are very competitive. Don’t accept the first offer you hear. Do comparative shopping.

Some patients’ financial histories make them ineligible for credit cards. Alternatively, a patient’s credit cards may be at their credit limit. In cases like these, there are finance companies that specialize in funding medical services. These credit plans have high interest rates and a requirement that the practice agree to pay the unpaid balance if the patient defaults.

An Internet search identified the following websites that offer patient funding services. (NOTE: the Academy has not researched these companies and makes no recommendations regarding their use.)

There are many other plans that can be accessed and researched by a quick web search.

Summary

The goal of utilizing patient funding programs, including use of credit cards, is to transfer the funding of your practice’s services from your accounts receivable to an entity that is in the business of providing financial services.

Many practices report that there is little resistance from patients to using credit cards; if the policy is well designed, well-rehearsed and well communicated, patients adapt easily.

The use of credit cards or funding programs can also be an asset in promoting elective services in your practice. Advertising refractive surgery with the tagline “we can provide financing” places you one step ahead of the competition.

Meet the Biller: Colleen Jenkins

Colleen Jenkins joined the PRMG team in June 2012. She is a graduate of Sanford Brown College’s Medical Billing and Coding Program. Prior to joining to PMRG, Colleen was a supervisor at a telecommunications warehouse in Memphis.

Colleen is a team leader and is responsible for several accounts located throughout the country. She is well versed in both the AdvancedMD and Compulink practice management systems. Colleen enjoys posting payments (the bigger the better), resolving old accounts, and problem solving.

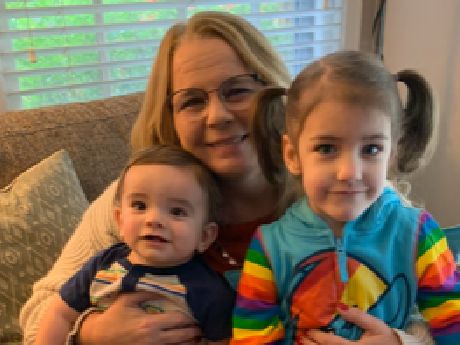

Colleen is the mother of three children, Jenna (25), Hailey (21) and Chance (18). She is also a grandmother to Reagan (4) and Caleb (1) both whom she enjoys spoiling. Colleen is an avid reader of a variety of genres, including fantasy, romance and detective series. She also enjoys knitting and listening to music.

We are lucky to have Colleen on the PMRG team!

Credentialing Corner

CMS announces National Plan and Provider Enumeration System (NPPES) as a Resource to Improve Provider Directory Accuracy for Medicare Advantage Organizations (MAO)

Effective January 2020, CMS is allowing MAO’s to use the NPPES data directory as a source to validate and update their records for participating providers in their plans. They are also being allowed to use this data to evaluate and solicit providers to participate in their plans in underserved communities, based on their patient demographics.

In an effort to guarantee accurate/up-to-date core directory data, NPPES has enhanced their site to allow for multiple practice locations to be listed. The site will also allow providers to certify that their National Provider Identifier (NPI) data is correct. This should help the MAO’s improve their directory information.

Please note this does not preclude you from having to the complete your contractual requirements to notify these entities of additions, terminations or changes within your practice, or your responsibility for quarterly roster validations.

We at PMRG highly recommend that you review the information listed on the NPPES site for both your group and individual NPI’s to make sure they are up to date.

Please feel free to reach out me at pmuhlenbruch@medicalpmrg.com if you have any questions.

“Everyone at PMRG was a Godsend for our startup practice. We would have been so completely lost without them!”

– Natalie, Carlsbad Eye Care